louisiana estate tax return

473001 provides the tax to be assessed levied collected and paid upon the Louisiana taxable income of an estate or trust shall be computed at the following rates. This means a couple can protect up to 2412 million when both spouses die for 2022 deaths.

Where S My Refund Louisiana H R Block

4 on the next 40000 of Louisiana taxable income.

. Though Louisiana wont be charging you any estate tax the federal government may. State income tax changes for 2022 and beyond. Does Louisiana Have an Inheritance Tax or Estate Tax.

Explore state tax forms and filing options with TaxAct. TaxAct can help file your state return with ease. If the amount withheld is overpaid a refund of the difference will be issued or credited to the tax liability for the following year based upon the.

Louisiana income tax changes that went into effect on Jan. Just like inheritance tax in Louisiana the estate tax is lifted. You are obligated to pay estate tax only to the federal government if the value of your estate surpasses the set limit.

Taxpayers may check the status of their Louisiana individual income tax return refunds using the Departments automated system. 1 have no impact on 2021 state income tax returns and payments due May 16. The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. The exemption is portable for married couples. Download and Print Forms Find download and print the latest tax forms for individuals.

Individual Extension Request File an extension for your individual income tax return. Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only Stocks and bonds Mortgages notes and cash Insurance Other miscellaneous property. This service is available 24 hours a day.

A nonresident who received gambling winnings from Louisiana sources and who is required to file a federal income tax return must file a Louisiana return reporting the Louisiana income earned. 2 on the first 10000 of Louisiana taxable income. Have your social security number and refund amount ready then dial 1-888-829-3071 toll-free and follow the instructions.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Fiduciary Income Tax Who Must File. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

Just because Louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far as the IRS is concerned. The gift tax return is due on April 15th following the year in which the gift is made. An inheritance tax is a tax imposed on someone who inherits money from a deceased person.

Louisiana Estate Tax Everything You Need To Know Smartasset Understanding Federal Estate And Gift Taxes Congressional Budget Office Estate Tax Examples Of Estate Tax Estate Tax Rate New Irs Requirements To Request Estate Closing Letter. Louisiana Department of Revenue Taxpayer Services Division P. Louisiana estate tax return Friday February 11 2022 Edit.

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. The deadline for filing 2021 Louisiana Individual income tax returns is Monday May 16 2022. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011.

Generally the estate tax return is due nine months after the date of death. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. In fact you may have to file all of the following.

Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Ad Download or Email IRS 706 More Fillable Forms Register and Subscribe Now. When a person passes away and the estate is worth more than the stipulated value even in Louisiana they are under the federal estate tax law.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. Federal Estate Tax. The portion of the state death tax credit allowable to louisiana that exceeds the inheritance tax due is the state estate transfer tax.

Your maximum refund guaranteed. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate.

Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must. Louisiana State Tax Refund Status Information.

Choose the best option for you to file your taxes. MyRefund Card The MyRefund Card is a secure efficient way to receive your Louisiana state income tax refund. Ad Looking to file your state tax return.

Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day.

Louisiana Legislature Calls Itself Into Second Extraordinary Session And Includes Certain Tax Issues Louisiana Law Blog

Gonola Tops Ways To Spend Your Tax Refund New Orleans Louisiana Nola Tax Refund

Louisiana Tax Deadline Extension And Relief For Winter Storm Victims Tax Deadline Winter Storm Storm

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Prepare And E File A 2021 2022 Louisiana Income Tax Return

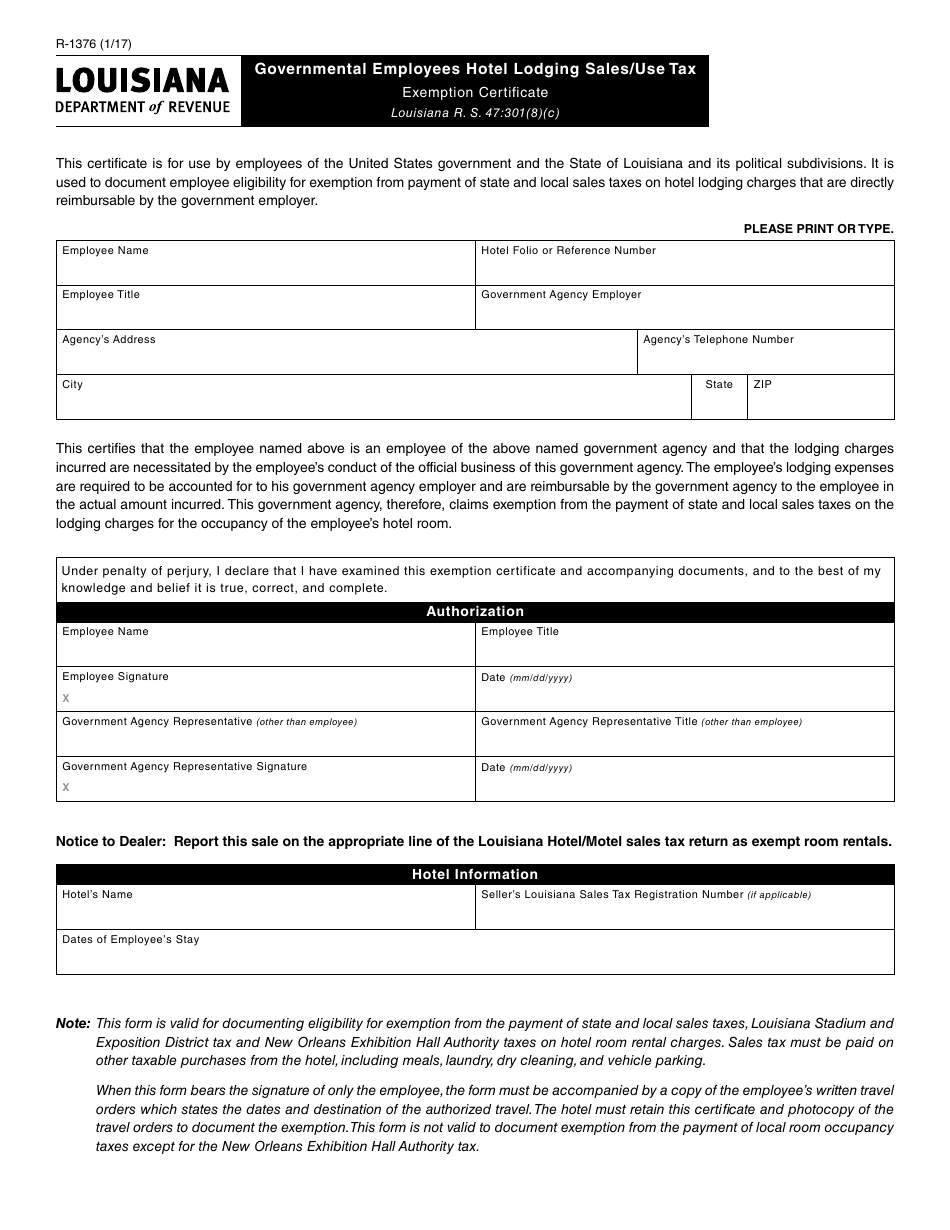

Form R 1376 Download Fillable Pdf Or Fill Online Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate Louisiana Templateroller